Based on the income tax slab an individual falls into they do their maximum tax saving. The upper limit of the tax credit ratio of 10 is temporarily increased to 14 until 31 March 2021.

Updated Guide On Donations And Gifts Tax Deductions

This maximum investment amount is decided by the government.

. In addition the tax credit limitation for certain RD venture corporations ie. However every section amongst these has a pre-set maximum investment amount. The most common sections in Income Tax Act are 80C 80CCD 1B 24 b and 80D.

Corporations established in the past ten years or less with carryforward losses and that are not a subsidiary of a large corporation is 40 of the corporate tax liability while the rate of 25 is.

Malaysia Personal Income Tax Guide 2021 Ya 2020

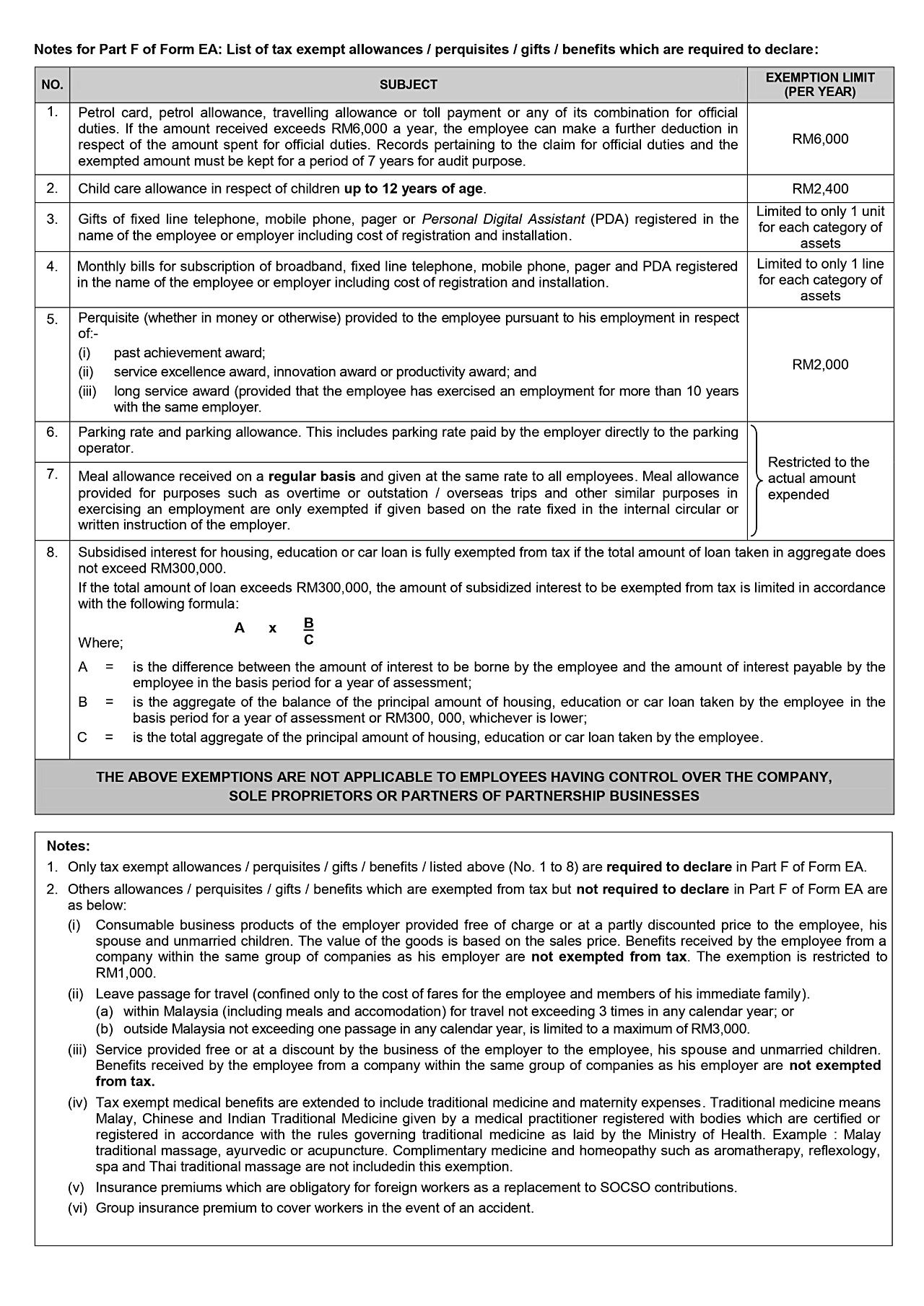

Allowance Guide In Malaysia 2021 Summary Of Lhdn Tax Ruling Seekers

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Updated Guide On Donations And Gifts Tax Deductions

Income Tax Malaysia Quick Guide To Tax Deductions For Donations And Gifts

What Type Of Income Can Be Exempted From Income Tax In Malaysia

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

Everything You Should Claim For Income Tax Relief Malaysia 2021 Ya 2020

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Claims For Income Tax Relief Malaysia 2022 Ya 2021 Funding Societies My

2020 Tax Relief What To Claim For Your Tax Deductions R Malaysia

5 Key Facts You Probably Didn T Know About Tax Deductibles In Malaysia

These Are The Personal Tax Reliefs You Can Claim In Malaysia

3 Simple Ways For 100 Tax Deduction On Your Donation In Malaysia

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star